Public Sector Reform for Personal Service Companies (PSC) in the Finance Bill 2017

In the Autumn statement the Government announced that it would go ahead with changes to the IR35 legislation for those working in the Public Sector.

Essentially the responsibility and accountability for determining whether IR35 applies will be changing to the Public Sector Body, instead of the PSC owner. IR35 itself and what it entails has not materially changed.

If your role is determined by the Public Sector Body to be within IR35 after April 2017, it is in all likelihood already within IR35 today.

The HMRC published draft legislation and guidance on the 5th December 2016; consultation will close on the 1st February 2017 and any changes will take effect on all payments on or after 6th April 2017.

You can read the guidance here:

https://www.gov.uk/government/publications/finance-bill-2017-draft-legislation-overview-documents

The greatest impact will be on those Personal Service Companies who have been operating in the belief that their assignment is outside of IR35, when it is determined to be within the IR35 by the Public Sector Body.

The change goes to the heart of how IR35 has been evolving; it is less about the contractual relationship and increasingly about the daily function undertaken. If it looks like or smells like a permanent role, you are within IR35.

What’s going to change for Personal Service Companies?

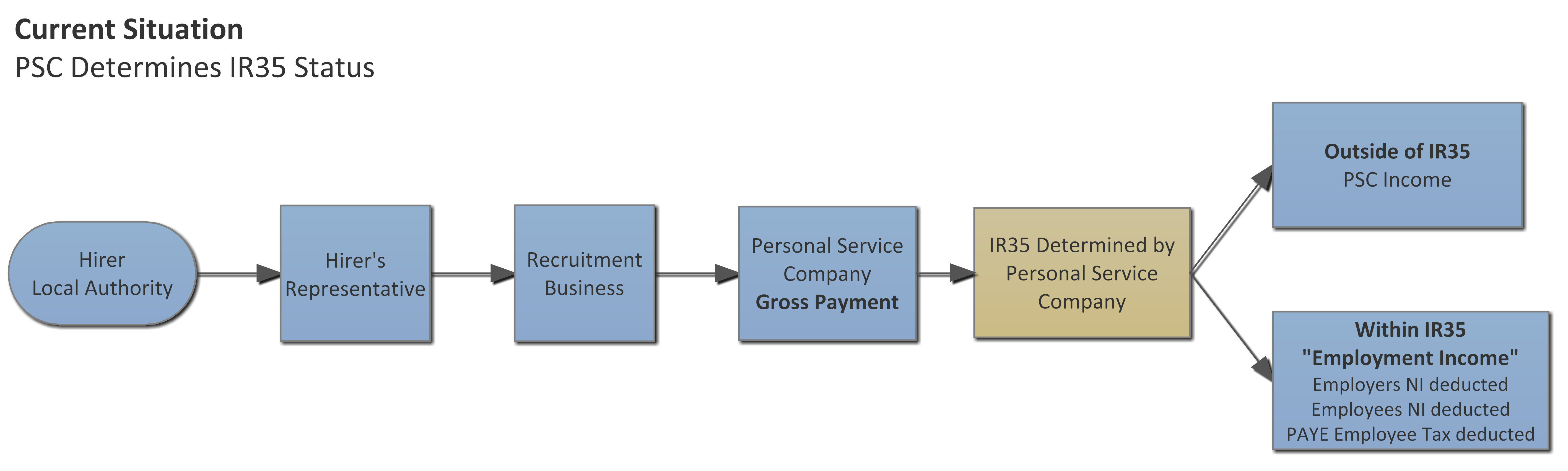

Presently, owners of Personal Service Companies in the Public Sector are responsible for ascertaining whether their assignment falls within or outside of IR35 legislation. Where the assignment falls within IR35 then PAYE taxes must be deducted by the PSC.

As you can imagine there is quite a moral hazard to argue that an assignment falls outside of IR35. The HMRC currently has an online tool that helps you decide, and they will be creating a newer tool for Public Sector Bodies. Often a PSC relies on the advice of their accountants or an army of IR35 third party experts undertaking IR35 reviews.

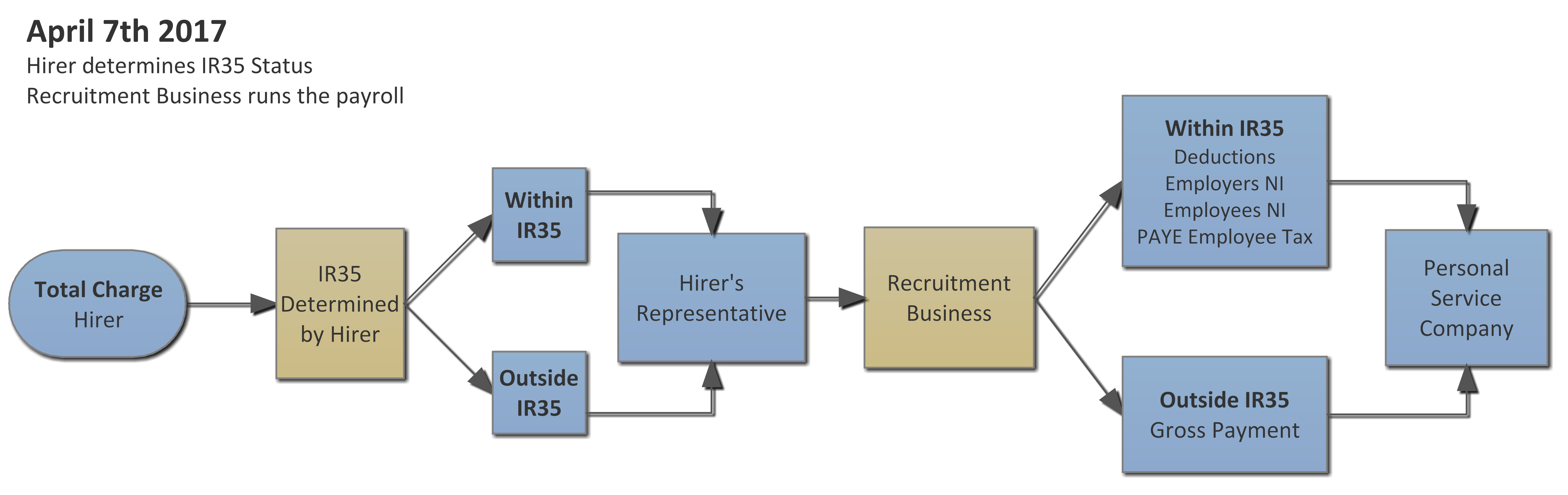

In the future, the Public Sector Body will be responsible for determining whether the new rules will apply, not the Personal Service Company.

Additionally, the party closest to the Personal Service Company, in this case Critical Project Resourcing Ltd, must put the individual supplied via the intermediary on its own payroll, deduct tax and national insurance, pay employers’ national insurance and report on the payment via Real Time Information. This is if the individual wishes to continuing being engaged through their PSC.

You would remain independent and not an employee.

In theory, if you have already determined your role was inside IR35 then we as your recruitment business get to do all your tax calculations for you and you save those business costs. In return it looks like you will lose the 5% allowance for costs which are excluded from being taxed on a PSC operated PAYE Scheme. Equally, the flat Rate Scheme for VAT looks like it will increase to 16.5%.

The Apprenticeship Levy of 1% of payroll will apply to many recruitment business if they operate your PSC PAYE and you might find that you need to cover those costs.

Who is affected the most?

Those already within IR35

Those who are inside of IR35 and the Public Sector Body determines the same will only be affected by some smaller changes to the Finance Bill, such as the loss of the 5% cost allowance and increase to the flat VAT rate.

Those outside of IR35

We believe there will be no change but are awaiting the draft legislation to confirm.

PSC acts as if outside IR35 but the Public-Sector body determines the role is within IR35.

The clear frustration will be for those that believe that they are outside of IR35, but the Public Sector Body determines the role falls within IR35. In these situations we must operate via PAYE Payroll.

This will be on a Real Time Information system and will be based on your NI number and latest tax code. Those affected will be able to adjust and offset payments against other tax bills.

What happens next?

We wait for the final legislation and information from the Public-Sector Bodies regarding each assignment and their determination. Once we know more we shall contact you to discuss the next steps.

We will continue to support the three available models which are:

Personal Service Companies (PSC) – Consultancy agreement between PSC and Recruitment Business, where we operate the Payroll if applicable (inside IR35 in the Public Sector)

Umbrella Companies – Employment by the Umbrella Company

Contract for Services (PAYE Temp) – Agreement between a self–employed individual and Recruitment Business

Predictions

We believe that Umbrella companies will become the favoured route for most Agency Workers, and they will increase their service offering to the agency workers. We expect to see additional employment related benefits such as insurance benefits and health benefits.

We expect that structured reasonable payroll costs will be applied to PSC in the public sector as the burden shifts from the PSC to the Recruitment Business.